As crazy market optimism that lending rates would fall in 2019 rebounded through various asset classes during the world, Bitcoin (BTC) and gold both reached new all-time highs on Monday.

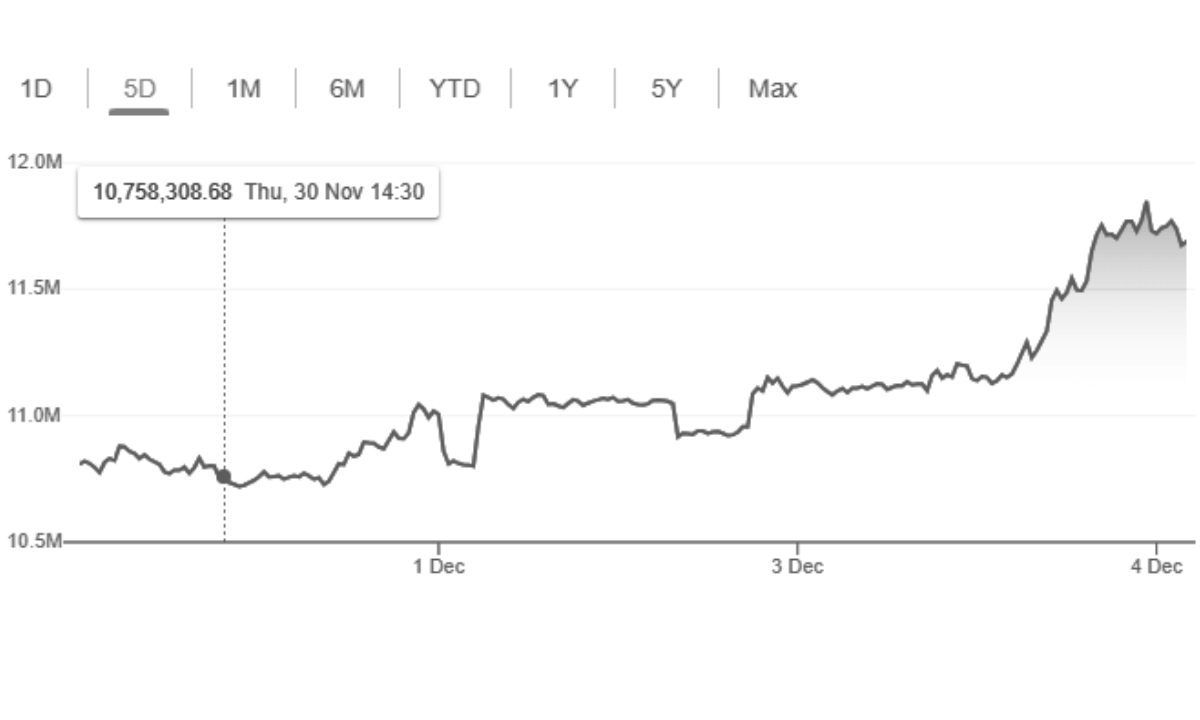

I hope that the industry’s toughest monetary penalties have been lifted led to Monday’s 8.2% increase in the cryptocurrency’s price, which increased to above $42,000.

Gold hit a new record high of $2,135/troy ounce on Monday, but then dropped to $2,069/troy ounces, based on LSEG stats.

Investor Sentiment and Federal Reserve Influence

As an outcome of increasing anticipation that the Federal Reserve would soon decrease borrowing costs—even if head Jay Powell said on Friday that it was “early” to declare that the central bank has won the war with inflation—there has been a recent burst of activity into treasuries and stocks.

Based on Luca Paolini, chief strategist of Pictet Investment Management, “you look at Bitcoin (BTC) and gold and can see a very comparable kind of movement.” “When the Fed cuts rates strongly, all of the stock categories that do well during that period do well.”

Because the cost of obtaining financing for both the government and business fell dramatically in November, when US bond markets enjoyed their best monthly gain in almost four years, traders are making assumptions that the first rate cut could come as early in March.

Because of a fall in rates on the ultra-safe US Treasury investments, investors are currently demonstrating increasing interest in other investments. The previous week had the S&P 500 index complete at a level that was not achieved since March 2022. Although inflation has decreased, recent US economic information has been powerful, which has boosted risky assets like stocks further.

An “everyone-is-happy-Goldilocks surge” across “virtually all assets classes” is dominating the markets, said HSBC chief multi-asset economist Max Kettner.

According to traders, investors’ increasing curiosity after the conclusion of two high-profile criminal cases that had tormented the market for the last year is a key factor boosting the selling momentum for Bitcoin (BTC), whose value has increased by over 25% in the last month.

Just last month, the United States is successful in investigating Sam Bankman-Fried, the previous CEO of FTX and Binance, one of the largest cryptocurrency exchanges in the world. In exchange for plead responsible to criminal charges relating to money laundering and financial sanctions violations, Binance paid fines totaling $4.3 billion, and Bankman-Fried was found responsible of deception.

Even though many traders are worried, US authorities chose not to shut down Binance. A further case against Binance has been launched by the Commission on Securities and Exchanges, which claims that Binance has broken securities regulations.

“The word from numerous institutional investors was that they required two items before looking at the sector again: closure on FTX and more information related to Binance,” said Henri Arslanian, the co-founder of Nine Blocks Administration, a crypto hedge fund management company located in Dubai.

Bitcoin (BTC) Resilience and Regulatory Developments

A cryptocurrency that saw major price action on Monday was Ethereum, which surged 8.3 percent to $2,260, its all-time high since May of last year.Another source of optimism for traders is the expectation that the SEC will shortly approve a Bitcoin (BTC) exchange-traded fund. For ten years, the SEC has been restricting exchange-traded funds, or ETFs, that invest in Bitcoin (BTC) on the spot market.

Additionally, face VanEck and WisdomTree filed with the SEC, but so have a few of Wall Street’s biggest financiers, such BlackRock and Franklin Templeton.“The word from numerous institutional investors was that they required two things before looking at the sector again: closure on FTX and more information surrounding Binance,” said Henry Arslanian, co-founder of Nine Blocks Administration, a crypto protect fund manager located in Dubai.

https://www.instagram.com/p/C0aGiXesmOV/

Other cryptocurrency that saw substantial price action on Monday was Ethereum, which surged 8.3 percent to $2,260, its all-time high since May of last year.

Another cause of optimism for investors is the possibility that the SEC will soon approve a Bitcoin (BTC) exchange-traded fund. For 10 years, the SEC has been blocking exchange-traded funds, or ETFs, that invest in Bitcoin (BTC) on the short-term market.

thankfully have VanEck and WisdomTree registered with the SEC, but so have some of Wall Street’s biggest financiers, like BlackRock and Franklin Templeton.Spot Bitcoin (BTC) ETFs have been viewed for years by many as an instrument by which traditional corporations like BlackRock might seize control of digital assets from crisis-ridden crypto companies.

Catalysts for Crypto Market Dynamics

Investment will buy into the narrative of the breakthrough impact opening the market to large investors would have on the ecosystem as a whole, according to Simon Peters, market researcher at eToro. “ETF speculation is going to keep influencing behavior in the crypto market this coming week,” Peters claimed.

With the SEC’s year-long attack on crypto, which has included enforcement measures against companies like US-listed return Coinbase, the agency is under increasing pressure to approve a bitcoin spot ETF.

a few days ago an appeals court in the United States determined that the SEC was incorrect in rejecting Grayscale’s attempt to convert its flagship product, the Grayscale Bitcoin Trust, into an exchange-traded fund (ETF). This was a major victory for the digital currency’s management.

Follow For More News Updates Click here